- Clean, pre IPO funded company

- Current project adjacent to Rio Tinto’s Rössing Mine (12% of World Production)

- Proven Uranium mineralization (Initial Resource 9Mlbs U3O8, Target 180Mlbs)

- Similar geology to Rössing Mine (active for 35 years)

- Excellent infrastructure on license area

- Mining friendly jurisdiction

- Impending Uranium supply shortage

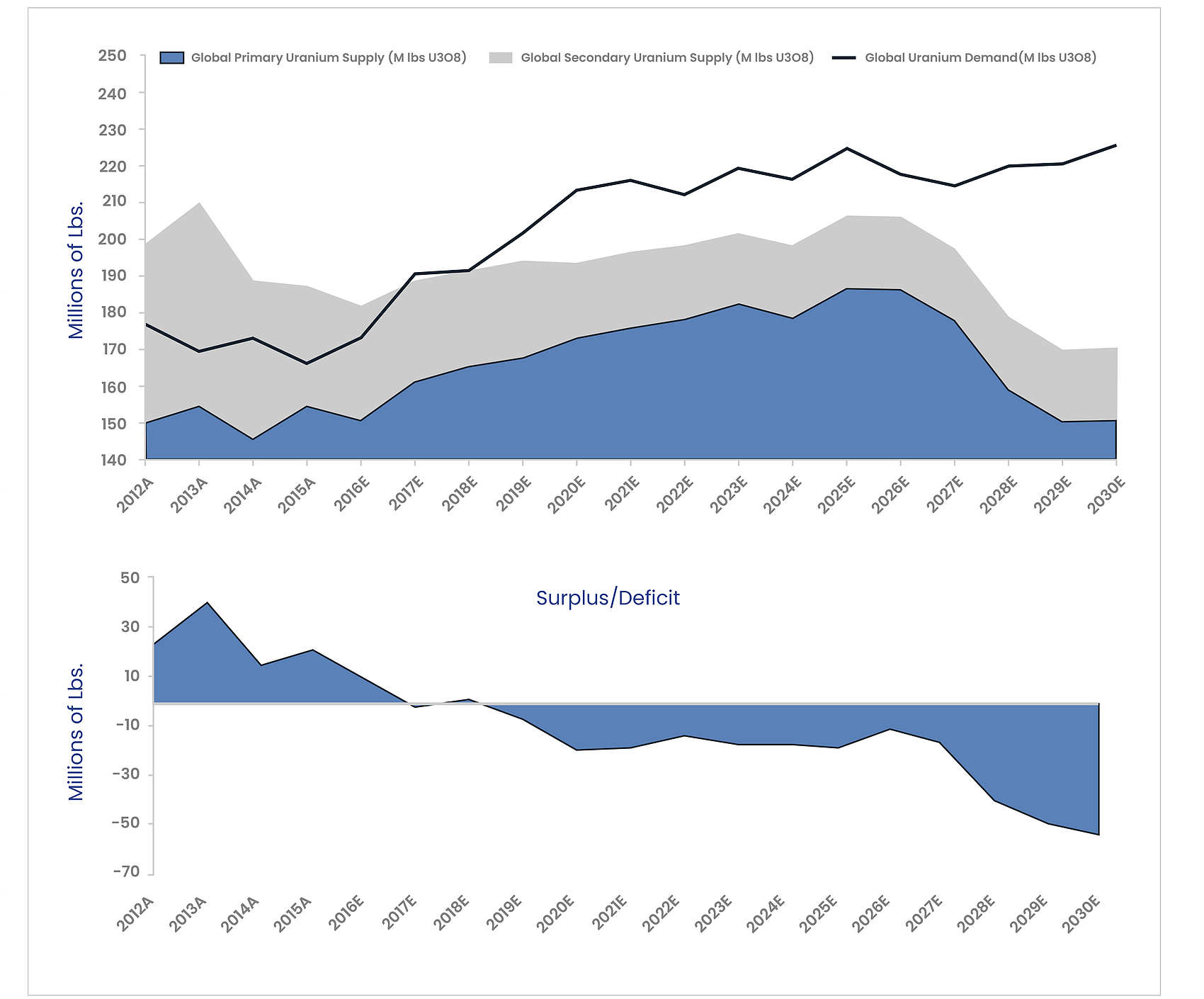

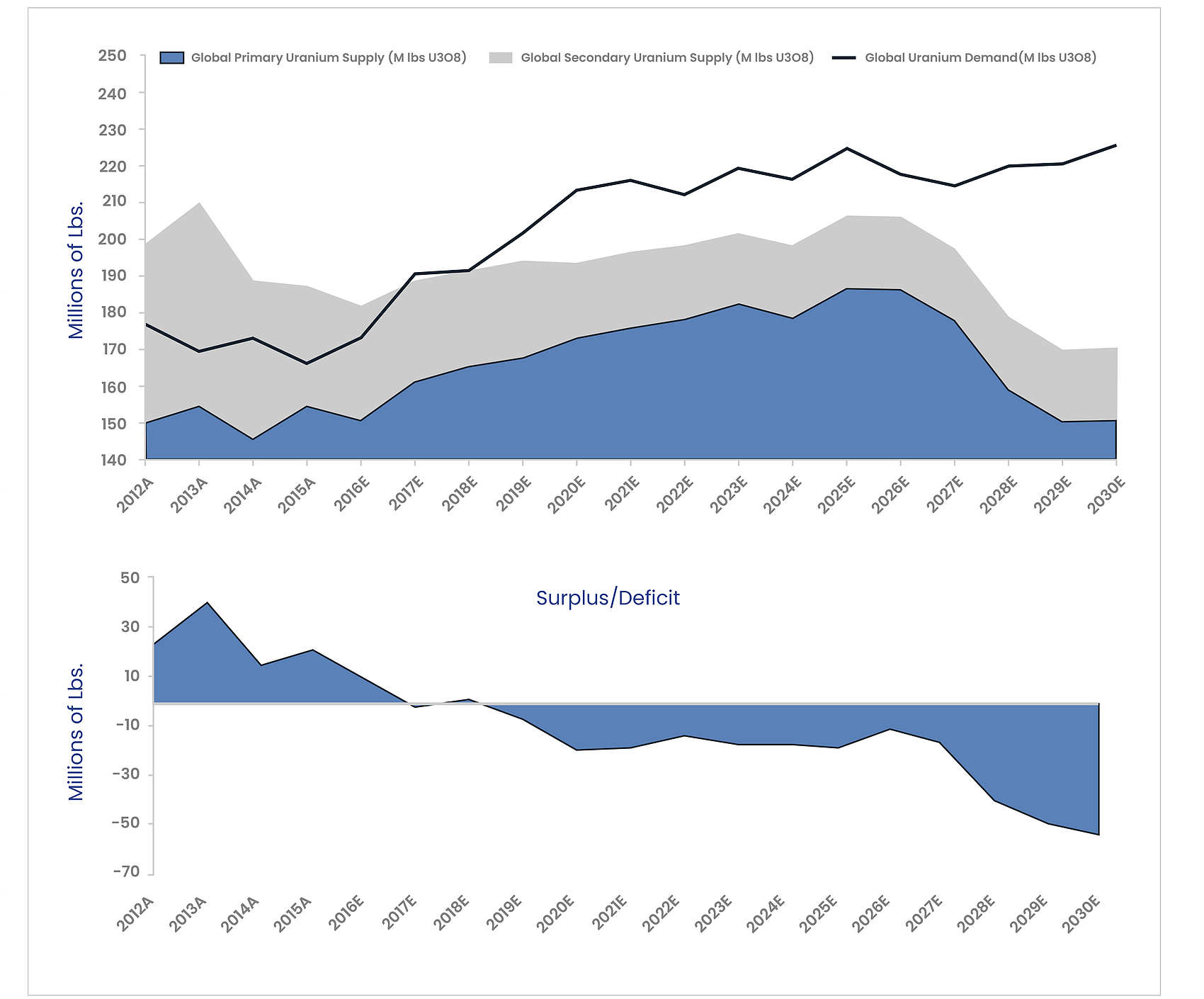

Market Fundamentals

- Currently no new production is coming online – most prospective mines need +US$60/lb Uranium to operate.

- Time taken from application to mine approx. 7-10 years.

- More new reactors increase the demand for supply while old mines are closing and reducing the ready supply for the market.

- At the same time secondary supplies are diminishing and primary producers are economically challenged.

- Years of inactivity has taken its toll on the junior market.

Demand Supply Deficit ( Source: Cantor Fitzgerald )

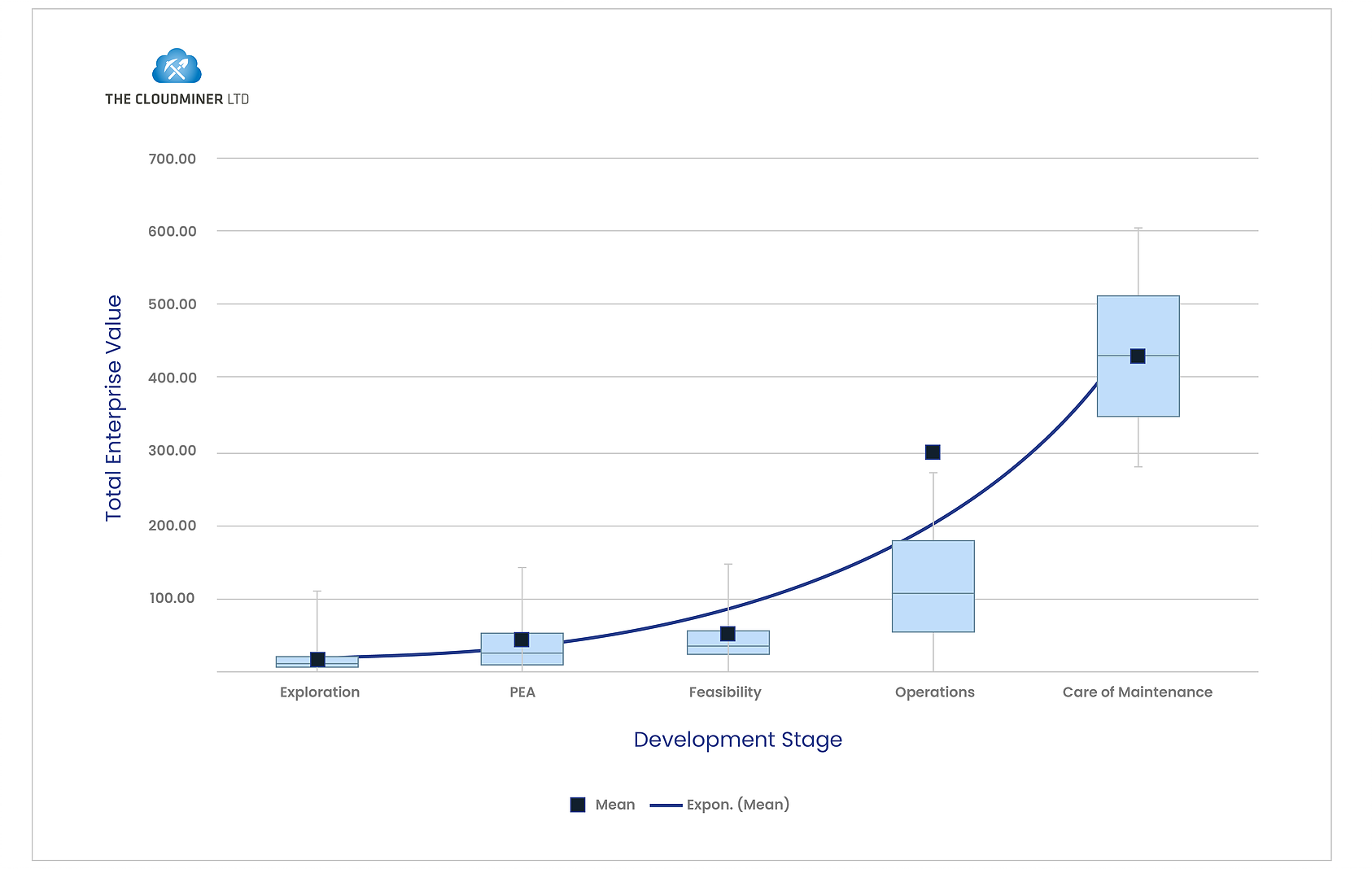

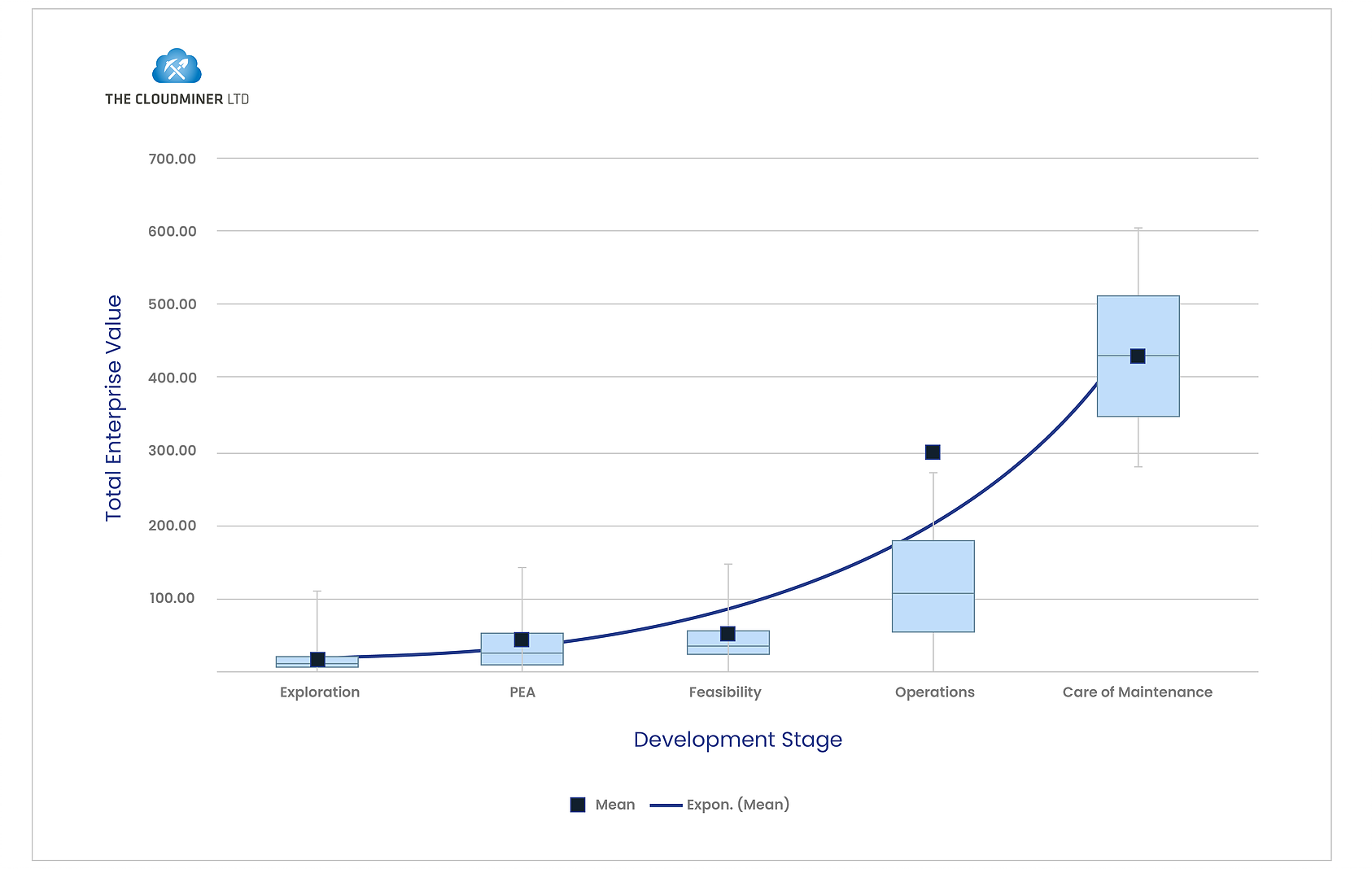

Undervalued Market = Opportunity

- Current operating mines in the US started Q1 2018 with average contract price above US$50/lb. Up from last year’s average of US$46/lb.

- Older mines going off line is creating an opportunity for newer, cheaper supply to cover the growing demand supply gap.

- Chinese state owned enterprise (SOE’s) continue to develop new mines (Husab, Namibia) as well as remaining in acquisition mode for both physical Uranium and Assets.

- The Market is still showing clear value accretion the closer to production an asset comes.

- Now is the time for fresh, clean assets.

Uranium Total Enterprise Value by Development Stage ( Source: The Cloudminer )